If you are a French subsdiary and you are looking for audit accounting firm or accountant in france, THEN THIS IS WHAT YOU SHOULD KNOW BEFORE CHOOSING ONE TO HIRE FOR A SERVICE.

This is about: accounting firms in france, accountant in france, french accounting firms, english speaking accountants in france, french accounting company, audit accounting firms in france...

Contents

Accounting vs Accounting Audit

What’s an Accounting Firm?

is a company specializing in accounting services for clients.

An accounting firm can manage a client’s payroll, receivables and payables, taxes and / or any other number of services.

Many accounting firms also offer auditing or consulting services.

What is audit accounting?

Audit accounting is playing a critical role in ensuring that a company’s accounts are accurate and finances are distributed in the most fair or efficient manner.

In other words, as companies and public sector organizations face increasing scrutiny over their finances, accountants are given the responsibility of reviewing financial records to make sure they are accurate and compliant.

What’s Difference between Accounting and Audit Accounting?

- An accounting: is involving the tracking, reporting, and analysis of financial transactions.

- An audit accounting: is an independent examination of accounting and financial records and financial statements to determine whether they comply with the law and generally accepted accounting principles (GAAP).

Auditing is the examination or inspection of multiple books of accounts by an auditor, followed by a physical check of the inventory to make sure that all departments are following the documented system of record transactions. It is done to verify the accuracy of the financial statements provided by the organization.

Frensh Subsidiary: Meaning, Status, Advantages & Disadvantages & How to Set Up

French Subsidiary means any Subsidiary of the Company incorporated now or hereafter under the laws of France.

- Frensh Subsidiary Status:

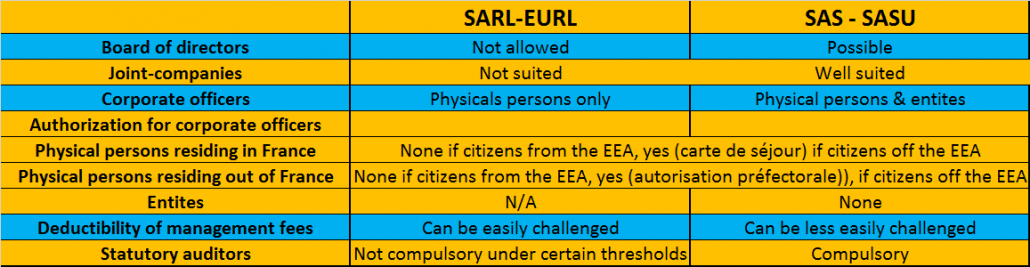

When a foreign company wants to create a subsidiary in France, it can select SAS status (simplified French limited company) or SARL status (French limited liability company).

- The advantages and disadvantages of each status:

The SAS is comparable to the company incorporated in the English-speaking countries (or the AG in Germany), while the SARL is closer to the LLC (English) or the GmbH (German).

How to Set Up a Subsidiary in France (a Quick Tour)

France is an economic powerhouse in Western Europe due to its location and membership in many European organizations. The government also supports foreign investors, making the country a great place to expand.

France has a stable and modern business climate perfect for startups and other organizations looking to make their mark.

You will need to consider several different factors during the France subsidiary setup process, such as what industry or type of business you want to organize.

Do you have any important business agreements or relationships? Have you considered the nationality of the people you want to hire? You will need to answer all of these questions before beginning the setup process.

The most common form of subsidiary is a limited liability company called SARL (limited liability company) in France. To create a private LLC, you will need to:

- Check the availability of your company name

- Open a commercial bank account

- Establish a physical office in France

- Appoint an auditor

- Publish the incorporation of your French subsidiary in the official newspaper

- Register your business for taxes, social security and insurance

- Stamp your company’s books at the Commercial Court

Subsidiary laws in France:

You will need to follow a number of French subsidiary laws when preparing to set up your subsidiary, including various French accounting and tax requirements.

If your business is outside the European Union (EU), the dividend withholding tax is 25%, but you can get lower taxes thanks to the double taxation treaties signed by France.

According to subsidiary laws of France, you will need:

- At least two natural or legal persons to set up the subsidiary

- At least one euro as a minimum share capital

- A manager residing in France or coming from the EEA

- Not more than 100 shareholders

A subsidiary established in France has its own legal personality and a large part of the capital owned by the foreign company. The foreign company cannot be held liable for the actions of the French company and its assets are fully protected in the event of the liquidation of the subsidiary.

Roles in the Audit Accounting Industry:

Audit accountants or firms like Vachon Associes, tend to fall into two main camps: internal auditors and external auditors.

- Internal auditors

Large organizations, especially those in highly regulated industries such as finance and the public sector, tend to hire audit accountants to help them achieve compliance and accountability.

In addition to ensuring that the books are balanced and that all entries and exits are accounted for, an internal auditor will identify areas where the business can become more efficient, especially when purchasing supplies for multiple sites.

- External audit accountants

Working externally gives you the opportunity to work with multiple organizations, checking their accounts to make sure they meet the requirements.

This could be related to tax liabilities for HM Revenue & Customs, allocation of funds for public entities, or financial health for private companies working with government organizations. Accounting auditors measure a variety of metrics, depending on who they work for.

Audit Accounting Firm for French Subsidiary Recommendations

If you manage a foreign company and want to start a business in France, or you have a branch or you are responsible for accounting and administrative obligations for a branch in France. An audit accounting frensh subsidiary can support you in all phases of your company’s life, like:

- Bespoke support and company development consultancy

- Accounting and financial management

- Corporate taxation

- Company law

- Payroll and Human Resources Management

- Audit and External Audit

- Strategic consulting…

An audit accounting firm, should optionally help you with your language and are fully conversant with international standards.

You can ask them to develop a business plan and set up an appropriate legal structure, with the advice of our network of lawyers and tax advisers, keep your accounts and report on the results of the subsidiary.

in the format used by your group, an audit accountant in france can help to complete all tax declarations and in particular manage VAT issues, manage human resources in compliance with French labor law: administrative relations with staff, drafting of employment contracts, establishment of payroll, preparation and payment of social contributions, etc.

Also can be adapted to each stage of your entity’s development. You can control costs by selecting the skills you need.

Accountant in france recommended optionally also to be

- Specializing in providing a wide range of services for English-speaking individuals and businesses in France.

- English-speaking department of Compagnie Fiduciaire.

- Operating for clients throughout France and for non-residents in many countries around the world.

- Providing services for all your accounting and tax needs.

- Also refer you to a consummate professional for specialized legal or financial advice.

This was about: accounting firms in france, accountant in france, french accounting firms, english speaking accountants in france, french accounting company, audit accounting firms in france...