CFD Trading on etoro provides many options for traders that would not be possible with traditional investing

Contents

What is CFD trading?

CFD trading is a trading method where a person contracts with a CFD broker instead of buying the underlying asset directly. CFD is the abbreviation for “Contract for Difference”.

In recent years, CFDs have become the most popular way for online investors to trade commodities, indices, currencies, and stocks.

Since CFD trading does not involve the real asset and operates independently of the market, it allows greater flexibility than traditional trading, for example access to foreign markets, leveraged trading, fractional shares and short selling.

Choose the best CFD trading eToro is a multi-regulated brokerToro is a multi-regulated brokerToro is trusted by millions of users.

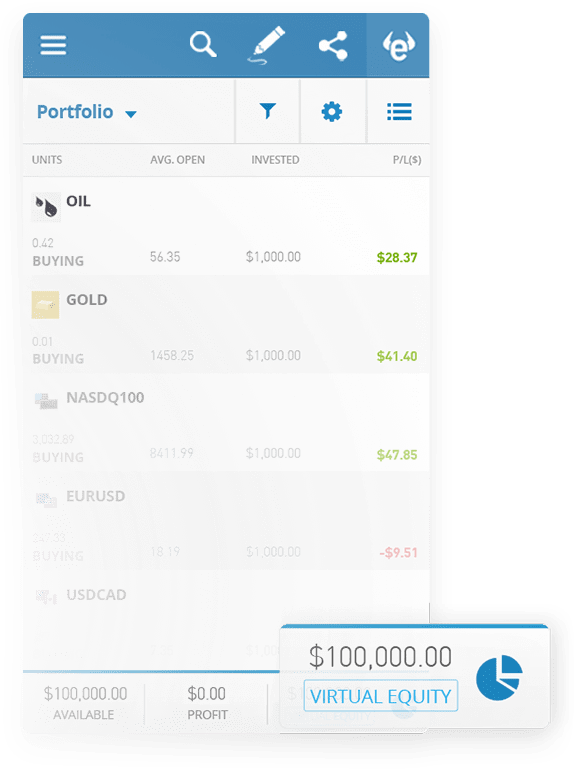

Transfer currencies, stocks, commodities, indices, etc. Management features such as real-time alerts and customizable stop loss Try eToro’s $ 100,000 demo account to experience risk-free CFD trading Toro’s innovative CopyTrader ™ lets you follow others traders and automatically copy their trades in real time Dedicated customer support 24 hours a day, Monday to Friday

FAQ about CFD trading on etoro

We’ll help answer your questions so you can start building your CFD trading portfolio today

What’s is CFD trading on etoro ?

CFD trading is a method that allows people to trade and invest in an asset by entering into a contract between them and a broker, instead of acquiring the asset directly.

The trader and the broker agree with each other to replicate the market conditions and adjust the difference between them when the position closes. CFDs (short for “Contract for Difference”) offer traders and investors the opportunity to profit from price movements in the financial markets without owning the underlying instrument.

How do CFD trading on eToro Work?

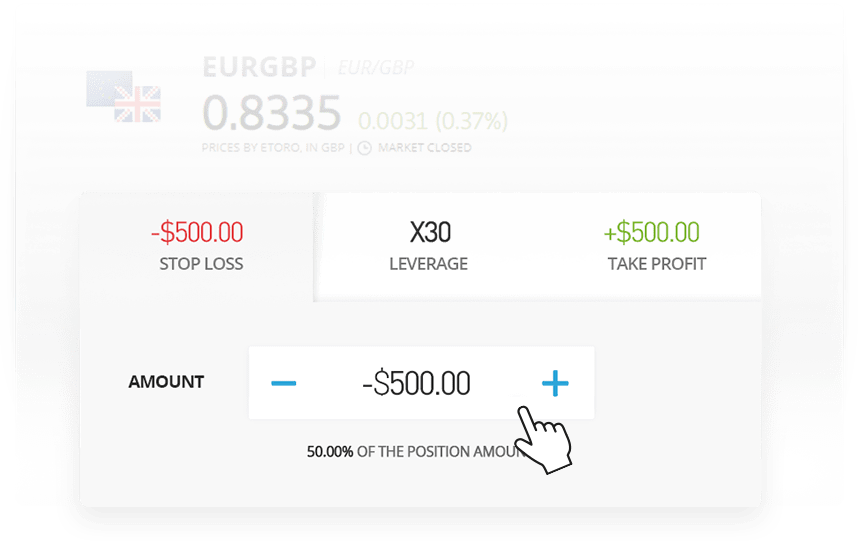

The trader chooses an asset that is offered as a CFD by the broker. This could be a stock, index, currency, or any other asset that the broker has in their selection. The trader opens the position and sets parameters, e.g. B. whether it is a long or short position, leverage, amount invested and other parameters.

Depending on the broker. The two of them conclude a contract and agree on the opening price for the position and whether additional fees (e.g. accommodation fees) will apply.

The position will be opened and will remain open until one of the traders decides to close it or it will be closed by an automatic command e.g. B. by reaching a stop-loss or take-profit point or by expiry of the contract.

When the position is closed in profit, the broker pays the trader. If it closes at a loss, the broker charges the trader the difference.

Which assets can I trade as CFD trading on eToro?

eToro offers CFD trading on currencies, commodities, indices, stocks, and cryptocurrencies.

Are there assets which can only be traded as CFD’s?

Yes. Indices like the DJ30 or SPX500, for example, are not true physical assets – you cannot own part of an index.

However, with CFDs, you can speculate on the performance of indices, allowing you to invest not only in a stock, but in entire sectors of national economies.

What’s leveraged trading ?

Leveraged trading means using the capital borrowed from a broker when opening a position.

Traders may sometimes want to apply leverage in order to gain more exposure with minimal equity as part of their investment strategy.

Leverage is applied in multiples of the capital invested by the trader, for example 2x or 5x or higher, and the broker lends This amount of money is a trader at a fixed rate. Leverage can be applied to both buy (long) and short (sell) positions. It is important to note that any losses and so will the profits.